Overcoming conservatism in the autonomous space revolution .

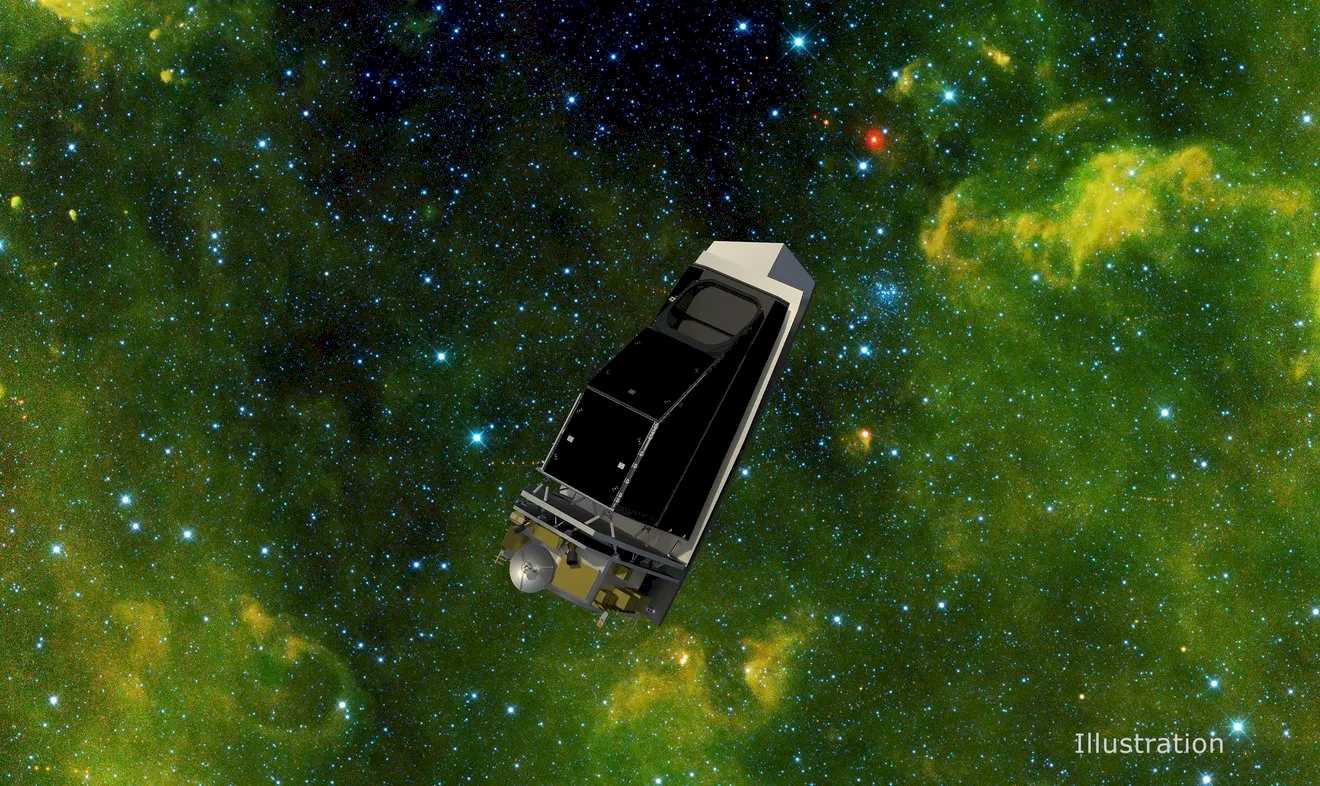

In the evolving landscape of space technology, a pivotal transformation is quietly taking shape: the development of spacecraft autonomy. While launch capabilities often dominate headlines, the real innovation frontier lies in what happens after they get there.

Think of autonomous spacecraft as the space equivalent of self-driving cars. For a decade, we’ve watched autonomous vehicles navigate our roads. Yet remarkably, despite the technology being available for years, fully autonomous spacecraft remain largely theoretical. This technological conservatism isn’t due to capability limitations — it’s driven by understandable risk aversion.

The hesitation is understandable. When missions cost hundreds of millions of dollars and failure means total loss, conservatism becomes the default. However, this cautious approach is increasingly unsustainable in the rapidly evolving space economy.

Why current operations don’t scale

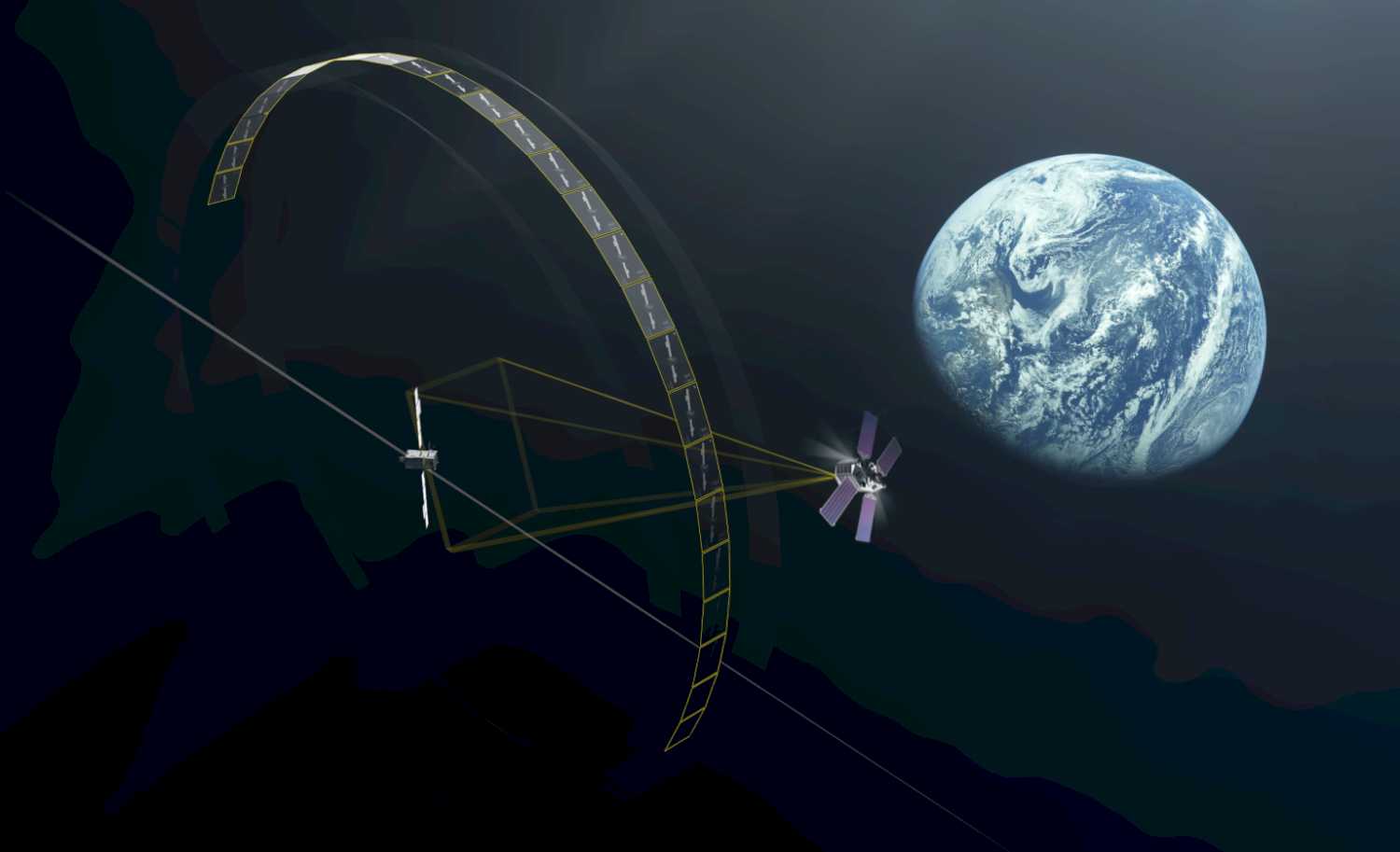

Traditional spacecraft Rendezvous and Proximity Operations (RPO) require continuous communication between ground control and the vehicle. In Low Earth Orbit, this communication is only possible during brief 10-minute windows every 90 minutes. The remaining 80 minutes? Complete blackout.

For complex maneuvers like RPO — delicately approaching other objects in space — this limitation creates enormous challenges. It’s like climbing Mount Everest and then performing the Nutcracker ballet at the top. Everything is moving at seven kilometers per second, and a single miscalculation can be catastrophic.

The industry’s current solution? Expensive satellite communication relays and 24/7 teams of engineers ready to respond instantly. This approach simply doesn’t scale for the constellation era, where we envision hundreds of satellites working in unison.

Learning from past failures

The industry’s risk aversion isn’t without precedent. NASA’s 2005 Demonstration for Autonomous Rendezvous Technologies mission failed to meet any of its objectives, reinforcing the sector’s conservative tendencies. Such high-profile setbacks have cast long shadows over autonomous spacecraft development.

Most current approaches involve incrementally testing small technological components rather than implementing comprehensive autonomy solutions. Companies typically manually guide spacecraft to predefined positions before testing limited autonomous capabilities in controlled environments — a slow, cautious path to full autonomy.

Creating truly autonomous spacecraft requires mastering several critical functions without constant human supervision. The system must handle path planning by autonomously calculating fuel-efficient orbital transfer routes, target identification by detecting and identifying objects from tens of kilometers away and visual navigation using onboard cameras and processing to understand a target’s position and movement. Additionally, it needs to perform proximity operations with safe maneuvers to approach and operate near other objects, along with error correction capabilities to make independent course adjustments when deviations occur.

Each of these challenges requires sophisticated algorithms that must function reliably in the harsh, unpredictable environment of space, where communication delays and outages are inevitable and testing opportunities are limited.

Breaking the cycle of conservatism

The space industry has reached an inflection point where operational demands are beginning to outpace traditional control methods. As satellite constellations grow larger and missions become more complex, autonomy shifts from luxury to necessity.

Breaking this cycle requires a dual approach: rigorous ground testing followed by incremental in-space validation. Advanced test facilities — where zero gravity motion and the harsh conditions of space can be replicated in controlled on-ground test environments – provide crucial stepping stones between simulation and actual deployment.

Achieving space autonomy requires everyone to play their part. The government can be a massive unlock for innovation, but as a nation, we must be willing to take risks, learn from our progress and share intelligence across borders. Part of the intelligence sharing further extends to our universities, which are already working on fundamental research challenges, particularly in artificial intelligence validation and verification. However, this research needs to come out of the labs and into the hands of established aerospace companies and emerging startups who can bring their systems integration expertise and flight heritage to drive nimble innovation in specific autonomy domains.

Buried in the hallways of universities, Australia’s emerging space sector is already contributing significantly to this transition, leveraging our world-class academic institutions, for example, the University of Sydney’s Australian Centre for Robotics and the University of Adelaide’s Australian Institute for Machine Learning. By focusing on autonomy solutions rather than replicating existing technologies, newer entrants to the space industry can establish leadership in areas where risk aversion has created innovation vacuums. Space development is not a zero-sum game – advancements in autonomous capabilities benefit the entire global industry, making collaboration the most effective path forward for Australia to secure its place among spacefaring nations.

The autonomous future

The benefits of autonomous spacecraft extend far beyond operational convenience. They will dramatically reduce costs by eliminating the need for constant monitoring, enable new mission profiles previously impossible due to communication constraints, and potentially increase reliability by removing the most common source of spacecraft failures: human error, often jokingly referred to as PEBCAK — “Problem Exists Between Chair And Keyboard.”

As space becomes increasingly commercialized, the economic imperatives for autonomy will only grow stronger. The companies and countries that master this technology first will establish the standards that others must follow.

The future of space operations is undoubtedly autonomous. The question is no longer if this transformation will occur, but who will lead it and how quickly they can overcome the industry’s inherent conservatism to bring these capabilities to market.

Justin du Plessis is Attitude and Orbit Control Systems Lead at Space Machines Company.

Space news on Umojja.com